If you’ve been in the trading or investing world for more than five minutes, you’ve probably heard of TradingView. It’s that platform everyone seems to name-drop when they talk about charting, technical analysis, or “making sense of the madness” in the markets.

I decided to test it properly—no quick glances, no surface-level poking around, but really digging into what it offers, where it shines, and where it might leave you scratching your head. What follows is not a glossy brochure—it’s the raw experience of someone who’s wrestled with charts at 2 a.m., tried every indicator under the sun, and still believes tools should serve the trader, not the other way around.

The Interface: Clean Yet Packed With Muscle

The first thing that hit me was how crisp and intuitive the interface feels. No clunky buttons or 1999-era dashboards—it’s modern, fluid, and honestly a joy to stare at for hours (because let’s be real, trading sometimes means staring until your eyes blur). You can resize charts, toggle indicators, and rearrange layouts like it’s second nature.

But here’s the kicker: underneath that clean look lies a beast of functionality. Multi-chart layouts, custom timeframes, and drawing tools that let you map out trends like a forensic detective—it’s all there. And the more you use it, the more you realize TradingView is like Photoshop for traders: easy enough to get started, but layered with depth for the obsessive.

Charting and Analysis Tools: The Heart of TradingView

This is where TradingView really earns its reputation. Over 100 built-in technical indicators, from simple moving averages to exotic ones like Keltner Channels. But the real magic? Pine Script.

Pine Script is their custom scripting language that lets you build your own indicators or trading strategies. At first, it looks intimidating (coding in a charting tool, really?). But once I tinkered with it, it clicked: this is how you go from cookie-cutter analysis to personalized setups. For instance, I was able to build a hybrid RSI + MACD alert system in under an hour, something I’d never find pre-packaged elsewhere.

And the backtesting feature—well, that’s a game-changer. You can run your custom strategies against historical data to see if they’d have worked. Spoiler: most of mine wouldn’t have made me rich, but it’s better to know that in simulation than lose your shirt in reality.

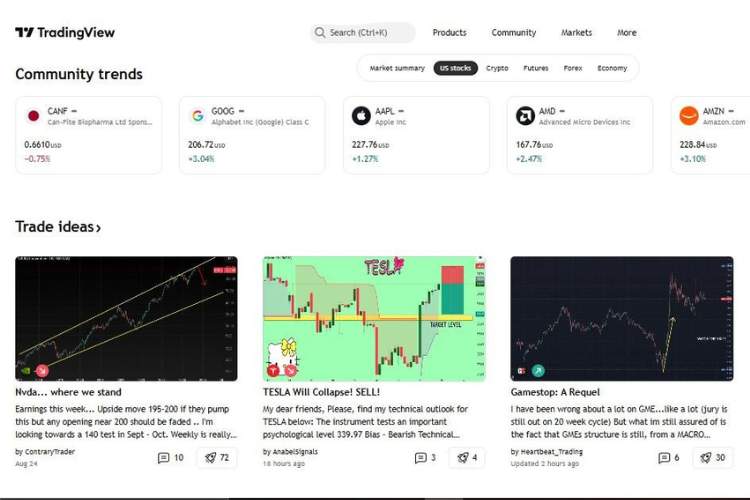

Community and Collaboration: More Than Just You vs. The Market

One thing that sets TradingView apart is its social layer. It’s not just charts and data; it’s a full-blown community. Traders post their setups, scripts, and market ideas like Instagram influencers posting selfies. And while some of it is pure noise (lots of self-proclaimed “gurus”), there are gems too—strategies and perspectives you wouldn’t stumble upon alone.

The ability to follow other traders, comment on their charts, and share your own setups makes the experience feel less lonely. Trading can be isolating—you vs. a candlestick chart—but here it feels like you’re in a bustling digital trading floor.

Assets and Data Coverage: One Platform to Rule Them All?

I expected stocks and forex. What I didn’t expect? The sheer variety. You’ve got crypto, futures, bonds, ETFs, indices—you name it, it’s there. And the kicker: it’s real-time (depending on your plan). This makes TradingView a true multi-asset playground.

If you’re someone dabbling in different markets, this is a huge plus. No more juggling five platforms to check how Bitcoin is doing while keeping an eye on Tesla stock and EUR/USD. It’s all centralized here.

Alerts, Automation, and Integrations

Alerts might sound like a boring feature, but TradingView makes them powerful. You can set alerts not just on price levels, but on indicators, trendline breaks, or even your custom Pine Script strategies.

And when the alert hits, you get notified via app, email, or even SMS. I tested a few, and let’s just say getting a text that “BTC crossed your moving average” feels like the closest thing to a market butler tapping you on the shoulder.

For automation, TradingView doesn’t execute trades directly (it’s not a broker), but it integrates with major brokers and third-party services. This means you can design strategies in TradingView and then link them to actually place trades through your broker.

Pricing: Does It Break the Bank?

Here’s the breakdown as I tested it:

| Plan | Price (Monthly) | Key Perks |

| Free | $0 | Basic charts, limited indicators, ads included |

| Pro | $14.95 | More charts, more indicators, no ads |

| Pro+ | $29.95 | Multi-device access, faster data, more custom tools |

| Premium | $59.95 | Everything unlimited, advanced alerts, best data |

Free is great for beginners, but serious traders will quickly bump into its limitations (only 3 indicators per chart, for example). Personally, Pro+ feels like the sweet spot. Premium is for the hardcore pros or those running multiple strategies simultaneously.

The Ups and Downs: My Honest Take

What I loved:

- Gorgeous, responsive charts you actually enjoy using.

- Pine Script for customization—it’s like Lego for trading.

- The community element—seeing real setups from real people.

- Coverage of nearly every asset under the sun.

What bugged me:

- No direct trading unless you integrate with a broker.

- Some features locked behind Premium feel like they should be standard.

- The social feed can get noisy with low-quality “predictions.”

Who Is TradingView Really For?

If you’re a casual investor just checking stock prices once a month, it’s overkill. But if you’re serious about trading—whether stocks, crypto, forex, or even just analyzing charts for fun—TradingView is hands down one of the best tools out there. Beginners will appreciate the free tier and intuitive design, while advanced traders will drool over Pine Script and the backtesting features.

For me, the biggest surprise was how quickly it became addictive. I found myself not just using it for analysis, but almost hanging out there—checking community posts, tweaking scripts, testing strategies. It’s more than software; it’s an ecosystem.

Final Verdict

TradingView doesn’t just hold up to its hype—it exceeds it. Sure, there are quirks and costs, but the balance of usability, depth, and community makes it one of the most powerful trading tools I’ve ever tested.

If I had to rate it:

- Ease of Use: 9/10

- Features: 9.5/10

- Community Value: 8.5/10

- Pricing Fairness: 8/10

Would I recommend it? Absolutely. For traders who want to level up without juggling a dozen different apps, TradingView is a no-brainer. It won’t make you profitable on its own—no tool will—but it will give you the clarity and flexibility to make smarter calls.