SignalStack is one of those tools that sits quietly in the corner of the fintech room but, once you notice it, you realize how much stress it can save you. I went in skeptical—another “automation” platform promising to cut out the noise?

But after spending time testing it with real signals, digging into its guts, and connecting it with a couple of my broker accounts, I came away thinking: this isn’t just convenient; it’s a genuine productivity boost.

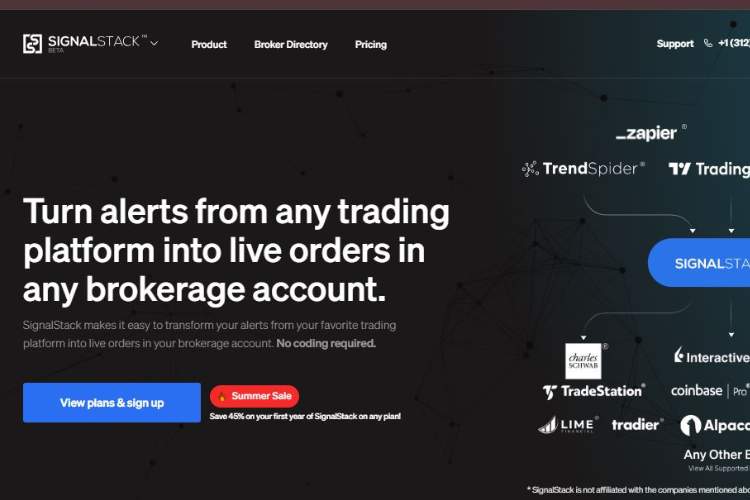

What Exactly Is SignalStack?

At its core, SignalStack acts as the middleman between your trading alerts and your broker. Most traders use charting tools like TradingView or analysis platforms to create alerts, but the weak link has always been execution.

You see a signal, you get an alert, you try to act on it—but by the time you’ve clicked “buy,” the market might already be three steps ahead. SignalStack eliminates that lag by automatically taking your alert and executing the trade directly in your connected brokerage or exchange.

It doesn’t replace your strategy—it replaces your mouse clicks. And honestly, that’s the biggest compliment I can give it: it’s not trying to be a flashy black-box “AI bot” that trades for you, it just does the boring-but-critical work of making sure your trades fire at the right time.

Setting It Up: Surprisingly Smooth

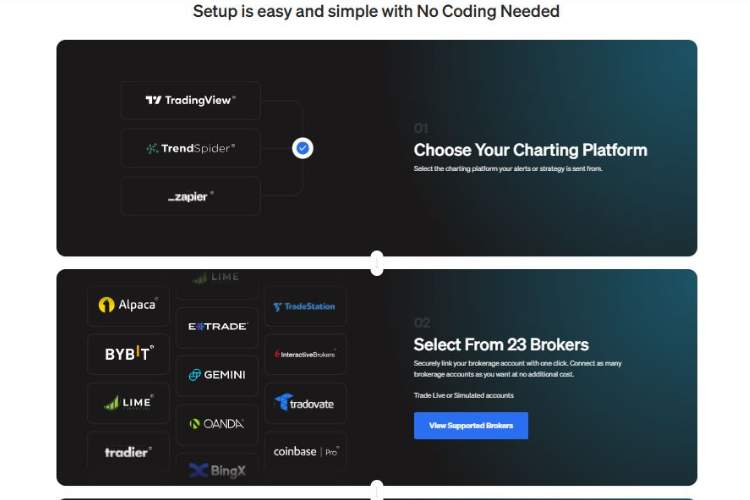

I’ve been burned before by tools that promise “simple integration” and end up requiring me to watch four YouTube tutorials just to connect an API. SignalStack was refreshingly different. After signing up, the setup flow guided me step by step:

- Connect my brokerage (in my case, Interactive Brokers and Tradier).

- Link my TradingView alerts.

- Define what each alert should trigger (e.g., buy 10 shares of XYZ, or short BTCUSD with a set position size).

The whole process took maybe 15 minutes. No coding, no headaches, no digging through endless documentation. For someone who values time (and hates technical rabbit holes), that’s huge.

Features That Actually Matter

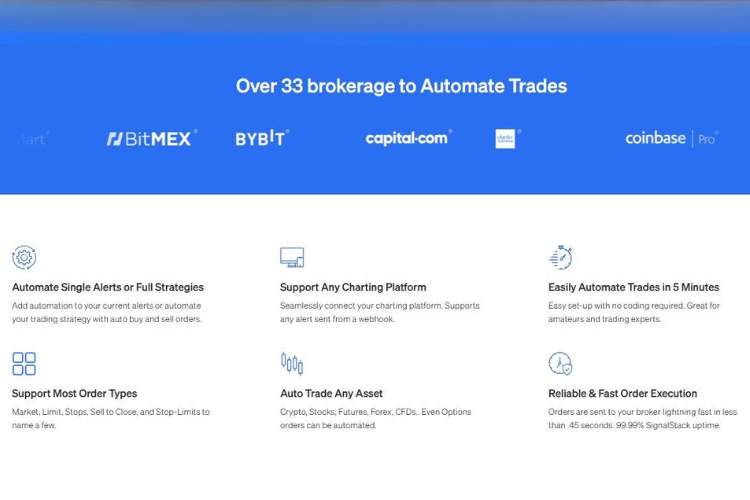

The platform isn’t bloated, which I love. Instead, it focuses on a few key features and does them well:

| Feature | What It Does | Why It Matters |

| Multi-Broker Support | Connects to multiple brokers/exchanges | Lets you manage stocks, options, futures, and crypto from one spot |

| Custom Position Sizing | Pre-define lot sizes per alert | Keeps you from over-leveraging by accident |

| Conditional Orders | Market, limit, stop-loss supported | Essential for risk management |

| Speedy Execution | Trades fire instantly after an alert | No more “oops, I missed it by 5 seconds” |

| Logging & Audit Trail | Records every execution | Peace of mind when reviewing what went wrong (or right) |

During my testing, I sent dummy alerts from TradingView and watched the executions pop in my brokerage account like clockwork. No lag, no slippage beyond what you’d normally expect in the market. It felt like magic—only, it’s just good engineering.

Pricing: Fair, Pay-As-You-Go

SignalStack uses a pay-per-execution pricing model rather than locking you into hefty monthly fees. This is clever because not every trader fires off 500 trades a month. You essentially buy credits, and each automated trade costs a certain number of credits.

For light traders, this model is economical. For heavy scalpers running dozens of trades per day, the costs could stack up, but then again, if you’re scalping at that level, speed of execution is literally your edge—and SignalStack might pay for itself by shaving seconds off.

Who Benefits the Most?

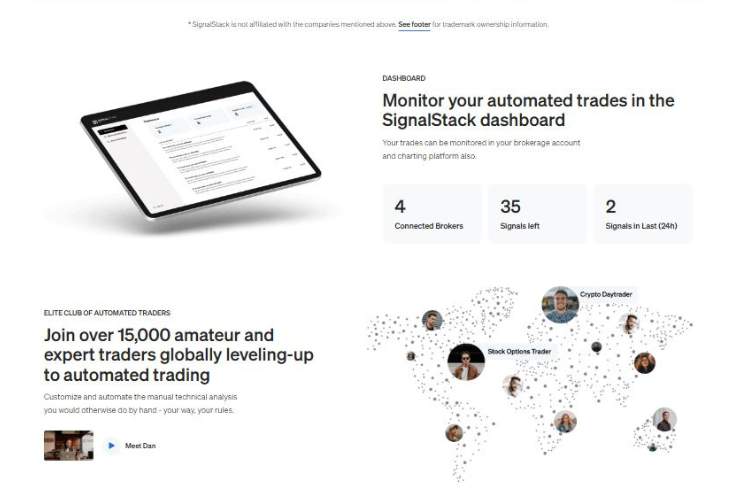

This is not a tool for everyone. If you’re a casual investor checking your portfolio once a week, SignalStack is overkill. But if you’re an active trader—stocks, forex, options, or crypto—it can be a lifesaver. I think it shines for:

- Day traders who rely on fast execution.

- Swing traders who want peace of mind that their strategy runs even if they’re away from the screen.

- Systematic traders who design alert-based strategies but don’t want to code.

It bridges the gap between retail and professional execution, which is why I’d argue it’s best suited for serious traders who aren’t quite ready to build custom algos.

My Honest Take: The Good and The Not-So-Good

What I loved:

- Incredibly smooth setup

- Reliable, fast execution

- Broker diversity (covering stocks, futures, crypto)

- Transparent, pay-as-you-go pricing

What made me grumble a little:

- Not every broker/exchange is supported yet (smaller ones are left out)

- If you’re a high-frequency trader, pricing could get expensive

- No “backtesting” feature for alerts—it relies on you having a solid system beforehand

The Emotional Angle

Here’s the thing—I’ve had days where my alert pinged during dinner, I rushed to my laptop, logged in, fat-fingered the wrong ticker, and ended up buying something completely different. SignalStack takes that stress away.

There’s a weird calm that comes from knowing that, even if you’re out walking the dog, your strategy will execute exactly as planned. That’s not just convenience—it’s trading psychology at its best. Less panic, fewer mistakes.

Final Verdict: A Quiet Game-Changer

SignalStack doesn’t scream for attention like some hyped-up AI trading bots, but maybe that’s the point. It’s a tool that stays in the background, quietly doing its job. For active traders who value precision and reliability, it’s a no-brainer.

If I had to give it a scorecard:

- Ease of Use: 9/10

- Execution Reliability: 10/10

- Pricing: 8/10

- Features: 8.5/10

- Overall Value: 9/10

Would I recommend it? Without hesitation. Especially if you’re already using TradingView or a similar platform for signals, this feels like the missing puzzle piece.