The idea of having a robot trade stocks for you sounds like science fiction, doesn’t it? Picture this: you wake up, roll out of bed, grab coffee, and while you’re still half-asleep scrolling TikTok, an algorithm is out there hustling in the markets on your behalf.

It’s a tempting thought, especially for beginners who don’t want to drown in charts and jargon. But is it really that simple—or is it just another shiny gadget in the world of finance that doesn’t quite live up to the hype?

Let’s be real: automation on Robinhood exists, but it’s not the magic money machine that some folks want it to be.

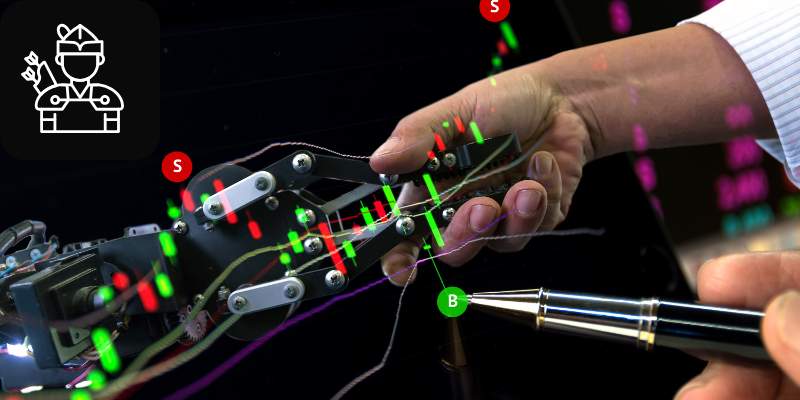

You can set up strategies, use third-party apps, and yes, lean on an ai stock trading bot that works with robinhood, but it’s more like having a diligent assistant than a Wall Street wizard. These bots thrive on rules, patterns, and past data.

They’ll help you stick to a plan—something human emotions often wreck—but they’re not clairvoyant. A sudden tweet from a CEO or a geopolitical shock? That’s the kind of curveball no bot can perfectly dodge.

The funny thing is, people often think of bots as either saviors or scammers, and the truth is somewhere in the messy middle. On one hand, they can help beginners avoid rookie mistakes, like panic selling at the wrong time.

On the other hand, if you blindly hand over the wheel, you might find yourself on a very bumpy ride. I’ve seen friends let algorithms run wild and end up wondering why their “perfect system” didn’t protect them from market madness. Bots aren’t lazy—they’re just blind to nuance.

For beginners, though, automation can feel like training wheels. You don’t have to obsess over every candlestick or earnings report. Instead, you can learn by watching how the bot reacts to different scenarios.

Sometimes it’ll nail a trade you never would have seen coming. Other times, it’ll miss the obvious because, well, computers don’t “feel” the mood of the market. And like it or not, markets are part math, part psychology.

Here’s the emotional bit nobody mentions: trading is personal. There’s a strange thrill in riding out a risky position or catching a breakout with your gut. Bots won’t feel that high or that sting, and maybe that’s their greatest strength.

They don’t care. But for me, part of the reason I even bother with trading is the human element—the story behind the numbers. That’s where I think beginners should tread carefully. Use AI to steady your nerves, to teach you discipline, but don’t give up the entire experience.

So, can you automate your stock trading on Robinhood? Yes. Should you expect it to make you rich while you nap? Probably not.

It’s a tool, not a treasure chest. The smart play is to start small, experiment, and keep your hands on the wheel even when the bot’s driving.

Automation can save you from emotional decisions, but success still requires curiosity, patience, and a pinch of skepticism. And honestly, that’s not a bad way to learn.