I’ve tested my fair share of AI-driven trading tools, but Kavout has always intrigued me. It promises more than just another set of stock screeners—it markets itself as a full-blown AI-powered investment insights platform.

So I carved out some time, dug into its features, and ran it through real use cases. The result? A mix of excitement, practicality, and a few raised eyebrows. Let’s break it down.

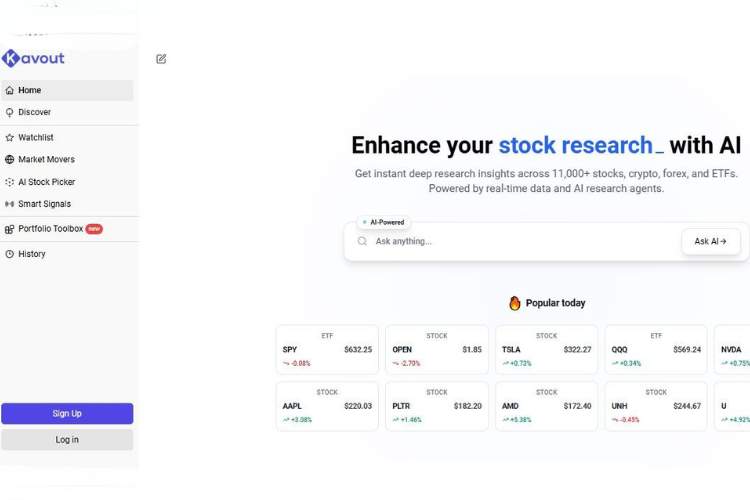

First Impressions: Serious, Data-Heavy, but Approachable

When I first landed on Kavout’s dashboard, I half-expected to be overwhelmed with walls of numbers. To my surprise, it strikes a neat balance.

It looks professional—something you’d expect from a quant firm—but it’s not cluttered or cold. The navigation feels intuitive, even for non-quants, though you can tell the system is designed with data-hungry investors in mind.

The big hook? Kai Score—Kavout’s proprietary AI ranking system for stocks. It’s like having an algorithmic analyst constantly crunching data for you.

Instead of drowning in spreadsheets, you get a simple 1-to-9 score that helps filter the noise. But before you think it’s a crystal ball, let’s be real: it’s still probabilities, not guarantees.

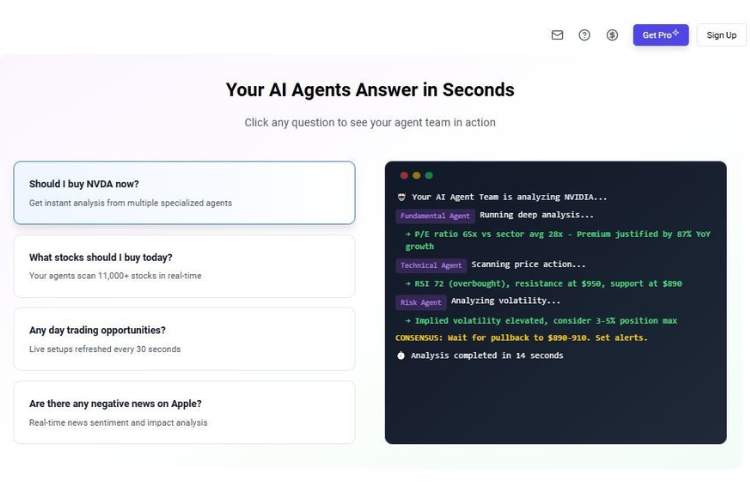

The Core Engine: Kai Score and Beyond

The Kai Score deserves its own section because it’s the heart of Kavout.

This score combines traditional financial metrics (like fundamentals and valuations) with alternative data (social sentiment, technical patterns, earnings revisions). Think of it as a stock report card written by a machine that never sleeps.

| Feature | My Take |

| Kai Score | Easy-to-digest numeric ranking, helps cut through analysis paralysis. |

| Backtesting Tools | Reliable for testing strategies, though you’ll want to double-check assumptions. |

| Portfolio Optimization | Feels powerful—especially if you’re juggling multiple assets. |

| Data Sources | Impressive range: fundamentals, price action, sentiment, analyst coverage. |

In practice, I found the Kai Score handy for quickly sorting watchlists. For example, when I tested it on the S&P 500, it surfaced some names I would’ve skipped otherwise—mid-tier tech firms with rising momentum.

A week later, a couple of them had solid gains. Coincidence? Maybe. But it definitely made me pay attention.

Usability: Who Is It For?

Let’s not kid ourselves—Kavout isn’t built for complete beginners. If you’re brand new to trading and don’t know your P/E from your EPS, you might find it intimidating.

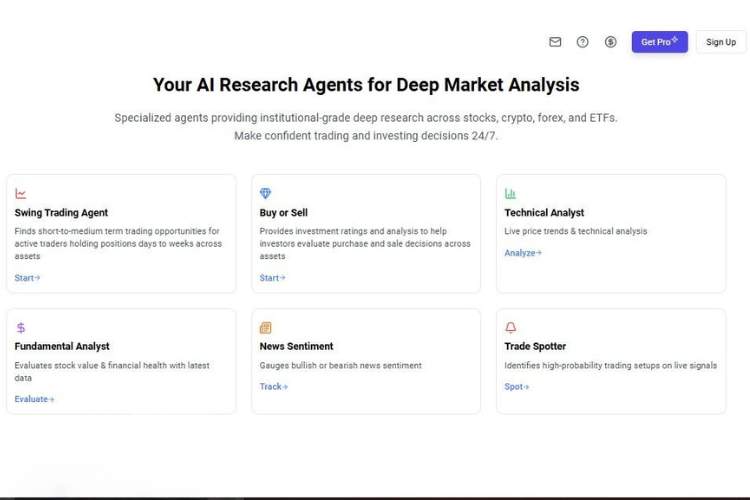

But for retail investors who’ve already dipped their toes into the markets and want something sharper than generic broker research, this feels like a game-changer.

It’s especially appealing for people who like quantitative trading but don’t want to build models from scratch. You can piggyback on AI insights without spending months learning Python or R.

I also noticed how institutional-like the reports feel—it’s like you’re sneaking into a hedge fund’s toolkit, only legally.

Integrations and Practicality

Kavout isn’t a brokerage—it won’t execute trades for you. Instead, it plays nicely with what you already use. You can connect it with portfolios you track and use it as a decision-making companion.

Personally, I see it as a research augmentation tool rather than a trade execution engine. That said, the fact it focuses so heavily on data analysis means it doesn’t try to be everything at once.

Some might see that as a downside compared to competitors like TradingView or Coinrule, which combine analysis and automation. But Kavout stays in its lane: insights first, trades second.

Pricing: Is It Worth the Money?

Kavout doesn’t throw out flat pricing tiers in the way consumer tools do—it’s more tailored. They offer solutions for retail traders, financial advisors, and even institutions. From what I’ve seen:

- Retail investors can access Kai Scores and stock rankings without breaking the bank.

- For professional users, the enterprise packages (with API access and deep integrations) obviously cost more.

Would I pay for it personally? If I were managing more than a casual portfolio, yes. For someone serious about using AI to support long-term strategy, it feels justified. But if you’re just dabbling in trading $200 on Robinhood, this might be overkill.

The Strengths and Weak Spots

What I liked:

- Kai Score simplifies complex analysis into digestible insights.

- Broad data coverage, mixing fundamentals, technicals, and sentiment.

- Portfolio optimization feels like something usually reserved for high-end funds.

- Sleek interface that doesn’t overwhelm despite handling big data.

What could be better:

- Not beginner-friendly—steep learning curve for casual investors.

- No direct trading—requires hopping between platforms.

- Transparency: I’d love more detail about how exactly Kai Score weighs different factors.

Who Should Use Kavout?

Kavout shines for semi-experienced retail traders, financial advisors, and institutions. If you want a smarter way to rank and analyze stocks without coding your own machine learning models, this is your tool.

It’s also great if you’ve been burned by “stock tips” and want a more systematic, data-driven approach. But if you’re just starting and need hand-holding or gamified apps, look elsewhere. This isn’t Robinhood with emojis—it’s more Bloomberg Lite with an AI twist.

Final Verdict

After spending time with Kavout, I can say it delivers what it promises: AI-powered investment insights that feel professional-grade.It won’t make decisions for you, but it will make you think differently—and maybe more clearly—about the decisions you do make.

If I had to put numbers to it:

- Ease of Use: 7/10 (better for those with some market knowledge)

- Data Quality: 9.5/10 (broad and reliable)

- Value for Money: 8/10 (great for pros, maybe pricey for casuals)

- Innovation Factor: 9/10 (Kai Score is genuinely useful)

Would I recommend it? Absolutely—but only if you’re serious about your trading or investing journey. Kavout isn’t about quick wins.

It’s about consistency, discipline, and arming yourself with better information than the average trader has access to. And in a world where data is everything, that feels like a solid edge.