I’ve spent enough time fiddling with crypto bots to know that most of them promise the moon and deliver, well, a calculator with a fancy skin. But then I stumbled on Bitsgap. To be fair, I was skeptical at first—too many glowing ads about “automated profits” can do that to you.

Still, after spending several weeks testing the platform across different exchanges and market conditions, I have to admit: Bitsgap has some serious depth.

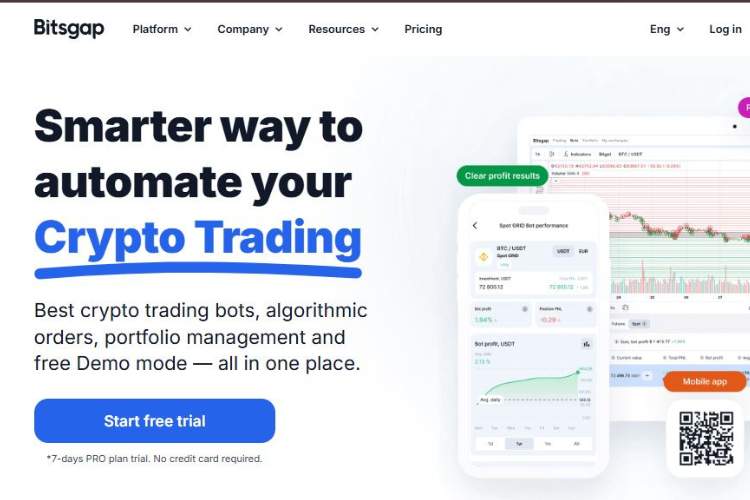

First Impressions: Clean, Modern, and Surprisingly Intuitive

The first thing you notice is the interface. Bitsgap isn’t trying to blind you with neon dashboards or bury you under technical jargon.

The design is clean, modern, and, dare I say, beginner-friendly. If you’re used to clunky interfaces that look like they were designed in 2009, this feels like a breath of fresh air.

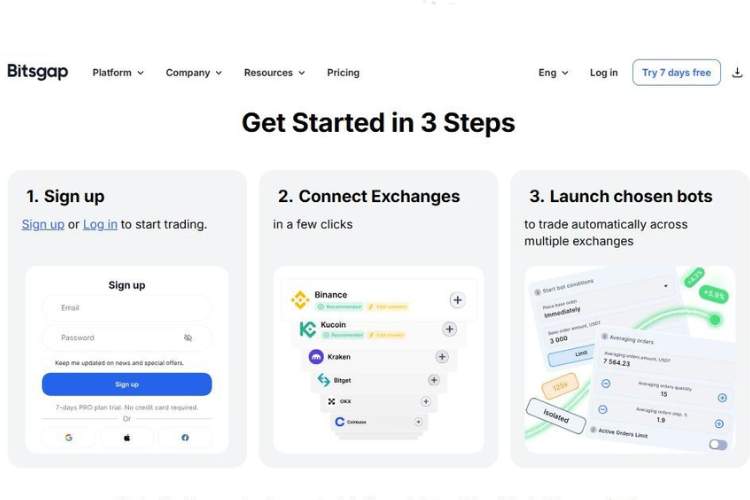

Connecting to an exchange is straightforward—you just plug in your API keys from Binance, KuCoin, Kraken, or whichever exchange you use, and you’re off to the races. No hidden hoops, no dodgy workarounds.

Within minutes, I had my trading data synced and was able to view all my positions in one neat, centralized dashboard. That in itself is a game-changer for anyone juggling multiple exchanges.

Features: Where Bitsgap Flexes Its Muscles

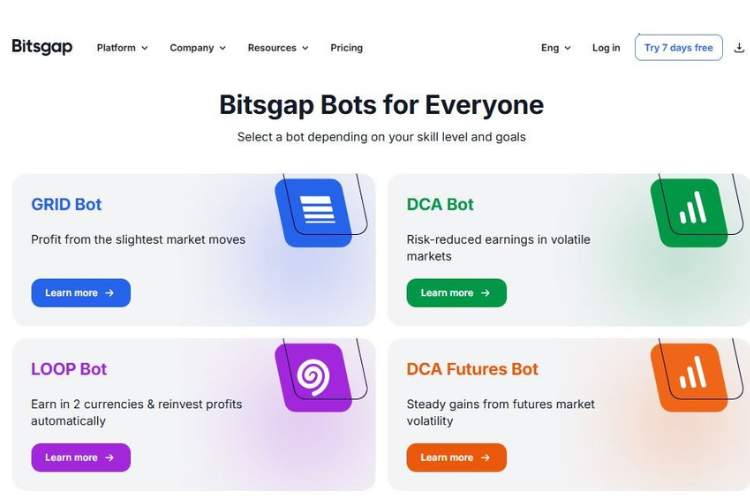

Now, here’s where things get juicy. Bitsgap isn’t just another “set-and-forget” bot—it’s a full-blown crypto management ecosystem.

| Feature | What It Does | My Experience |

| Grid Bot | Automates buy-low, sell-high strategies within a price range | Worked wonders in sideways markets—steady drip of profits |

| DCA Bot | Averages out entry points to reduce volatility | Saved me during those sharp Bitcoin dips |

| Combo Bot | Hybrid of grid + DCA | Complex but powerful; great for trending markets |

| Arbitrage | Exploits price differences across exchanges | Interesting but risky; not for the faint-hearted |

| Demo Trading | Play with fake funds | Perfect for testing crazy ideas without losing sleep |

| Smart Orders | Advanced order types like stop-limit, trailing stops | Felt like pro-level trading tools, but simple enough to use |

What really stood out to me was the demo trading feature. I can’t stress this enough—being able to test your bots without risking real money is priceless. It lets you experiment, make mistakes, and learn without burning a hole in your pocket.

Exchange Integrations: A Pretty Wide Net

Bitsgap integrates with over 15 exchanges, including big hitters like Binance, Coinbase Pro, Kraken, KuCoin, Huobi, and Bitfinex.

That’s a wider range than many competitors, giving you flexibility to spread your strategies. For someone who likes to diversify across platforms, this is a huge plus.

Pricing: Not the Cheapest, But Worth It

Here’s the breakdown:

| Plan | Price (per month) | Bots Allowed | Key Extras |

| Basic | $29 | 2 bots | Demo trading, portfolio management |

| Advanced | $69 | 5 bots | Trailing up features, more signals |

| Pro | $149 | 20 bots | Arbitrage access, priority support |

At first glance, the $149/month Pro plan feels steep. But when you consider the features—like arbitrage, 20 bots running simultaneously, and all the pro-level trading tools—it starts to look reasonable.

That said, the $69 Advanced plan feels like the sweet spot for most traders. You get enough bots and tools to build a serious strategy without breaking the bank.

Performance: Does It Actually Work?

Let’s get real for a moment. A bot doesn’t magically create money—it executes strategies. Your success depends heavily on the market and how you set things up.

That being said, my grid bots on ETH and SOL performed admirably during a sideways week, pulling in consistent small profits. The DCA bot helped me average down on a losing BTC trade, which softened the blow when the price rebounded.

Arbitrage was trickier—on paper, the opportunities looked great, but once you factor in exchange fees and slippage, the profit margins shrink. It’s doable, but you need to be sharp.

What I appreciated most was how transparent Bitsgap feels. There’s no sugarcoating. They give you the tools, the data, and the interface, but they don’t peddle illusions of overnight wealth.

Pros vs. Cons: My Honest Take

What I loved:

- Smooth, intuitive interface

- Wide exchange integrations

- Demo trading (seriously, every platform should copy this)

- Multiple bot types for different market conditions

- Centralized portfolio view across exchanges

What bugged me:

- Pro plan is pricey for casual users

- Arbitrage isn’t beginner-friendly (though that’s true everywhere)

- No mobile app as slick as the desktop—mobile feels like an afterthought

Support and Community: Helpful Enough

Support was decent—replies within a few hours, and the FAQ/knowledge base is solid. The Telegram group has active users sharing setups and results, which is a goldmine if you like learning from others. I’d rank it above average compared to other crypto bot platforms.

Who Is Bitsgap Really For?

Bitsgap is best suited for intermediate traders who want automation without writing code, and who value the ability to centralize their trading across exchanges.

Beginners can get a lot out of it thanks to demo trading, while advanced users will appreciate the Combo bot and arbitrage features.

If you’re just dabbling in crypto, Bitsgap might feel like overkill. But if you’re serious about building strategies, testing, and scaling them, this tool is a powerhouse.

Final Verdict: My Scorecard

Bitsgap is one of those rare platforms that feels polished, practical, and versatile. It doesn’t overpromise, it delivers consistent results if used wisely, and it’s flexible enough to grow with you as a trader.

- Ease of Use: 9/10

- Features: 9/10

- Pricing: 7.5/10

- Performance Potential: 8.5/10

- Community & Support: 8/10

Would I recommend it? Absolutely. For anyone serious about crypto trading, Bitsgap is a strong contender in the crowded AI bot space.