There’s something about pairing Coinbase with a smart AI trading bot that makes you feel like you’ve got a secret weapon in your pocket. I’ve been tinkering with these bots for months—sometimes with small wins that made me grin, sometimes with stumbles that made me rethink everything.

But that’s trading, right? It’s equal parts strategy, patience, and making peace with the fact that markets don’t owe you anything.

In this post, I’m laying out my personal experience with nine different AI trading bots and platforms that integrate (or play nicely) with Coinbase. Some of them acted like seasoned pros, others more like eager interns who still needed training wheels.

All of them, however, taught me something about how automation can either make you sharper or lazier—depending on how you use it.

Best AI Trading Bots That Work with Coinbase

1. Bitsgap

Bitsgap is like the Swiss Army knife of crypto trading. It’s an all-in-one platform for automated trading, portfolio management, and arbitrage across multiple exchanges—including Coinbase Pro.

I first tried Bitsgap because I wanted to test grid bots without coding. Within minutes, I had trades running automatically, buying low and selling high in tiny, frequent steps.

What struck me was how polished the interface felt—slick, but not intimidating. And the dashboard kept my open positions, bot performance, and portfolio in one neat view.

Bitsgap’s bots aren’t just simple “buy/sell” scripts. They’re customizable to your risk appetite—tight grids for scalping, wider grids for more swing-like strategies.

The platform also supports futures trading, backtesting, and even cross-exchange arbitrage, though the latter works better if you’ve got capital spread across multiple platforms.

Core Features & Use Cases

- Grid bots, futures bots, and DCA bots

- Portfolio tracker for all connected exchanges

- Built-in backtesting tools

- Arbitrage detection across exchanges

Who is it for?

Traders who want automation without diving into code. Especially useful for people who like multi-exchange flexibility but want a single control center.

Opinion

This one felt like a safe starter kit with plenty of room to grow. I kept coming back to it when I wanted “productive automation” instead of speculative gambling.

2. Aterna AI

Aterna AI is more like the quiet, consistent trader in the corner who’s too busy compounding gains to brag. Its main promise is steady returns—around 4% a month—through a hands-off automated strategy. I was skeptical at first because those numbers are modest in the flashy crypto world, but after testing it, I realized that was the point.

Aterna doesn’t try to chase every spike or trend. Instead, it sticks to a calculated policy-based system, monitoring market conditions and executing trades without your intervention. You can check progress through a clean dashboard, but you won’t find a flashy UI full of blinking trade signals.

Core Features & Use Cases

- Fully automated trading with low volatility targets

- Minimal user input required—set it and leave it

- Risk controls baked into its strategy

Who is it for?

Long-term thinkers, people who value stability over adrenaline. Perfect if you’d rather treat crypto like a steady investment rather than a heart-racing hobby.

Opinion

It was the least stressful bot I tested. I could forget it for days and not worry it was making wild bets behind my back.

3. Tickeron

Tickeron is an AI-driven marketplace of trading ideas. It covers stocks, ETFs, forex, and crypto, but the crypto side integrates with Coinbase Pro to execute AI-powered predictions. My favorite part was browsing their AI trend prediction charts—they don’t just show buy/sell signals; they break down probabilities and pattern recognition in plain language.

Core Features & Use Cases

- AI trend prediction for various markets

- Pattern search engines for chart formations

- Backtested strategies with performance metrics

Who is it for?

Analytical traders who love stats and probabilities. If you want AI to explain why it thinks a trade is promising, Tickeron’s worth exploring.

Opinion

I appreciated the transparency. Even when a prediction didn’t pan out, I could see the reasoning behind it, which made me a better trader.

4. TradeIdeas

TradeIdeas is like a hyperactive trading desk in software form. While its core market is stocks, crypto traders can still benefit from its scanning, alerting, and backtesting features—then sync insights with Coinbase-compatible bots or APIs.

Core Features & Use Cases

- Real-time market scanning

- Holly AI assistant for trade ideas

- Backtesting with OddsMaker

Who is it for?

Active traders who live for constant data flow and are comfortable adapting stock tools to crypto markets.

Opinion

It was a bit like drinking from a firehose—useful, but you have to pace yourself or risk decision fatigue.

5. Coinrule

Coinrule is a rules-based automation tool that works directly with Coinbase. You can build custom strategies without coding by using their “If This, Then That” style builder. My first rule was something basic—buy ETH if it dropped 5% in a day, sell if it bounced 7%. Watching it execute without me lifting a finger was oddly satisfying.

Core Features & Use Cases

- No-code strategy builder

- Pre-built template strategies

- Real-time execution on linked exchanges

Who is it for?

DIY traders who want to control strategy logic but not manually execute trades.

Opinion

It felt empowering—like I could automate my own brain without writing Python.

6. Intellectia

Intellectia blends AI analytics with a chat-style interface. It can break down market trends, highlight trade setups, and even explain why it’s bullish or bearish. I liked using it to double-check my hunches before acting.

Core Features & Use Cases

- Natural language queries

- Real-time alerts and insights

- AI-curated watchlists

Who is it for?

Traders who want to learn as they go, or those who value context with their signals.

Opinion

It’s like having a calm, knowledgeable friend in your corner—helpful when the market feels chaotic.

7. TradeSanta

TradeSanta is a cloud-based crypto bot platform with pre-built long and short strategies. It connects to Coinbase Pro and lets you automate trades based on technical indicators.

Core Features & Use Cases

- Long/short bot templates

- DCA and grid strategies

- Mobile app for on-the-go management

Who is it for?

Casual traders who want a ready-made bot without tinkering too much.

Opinion

Easy to set up, though less customizable than some power-user platforms.

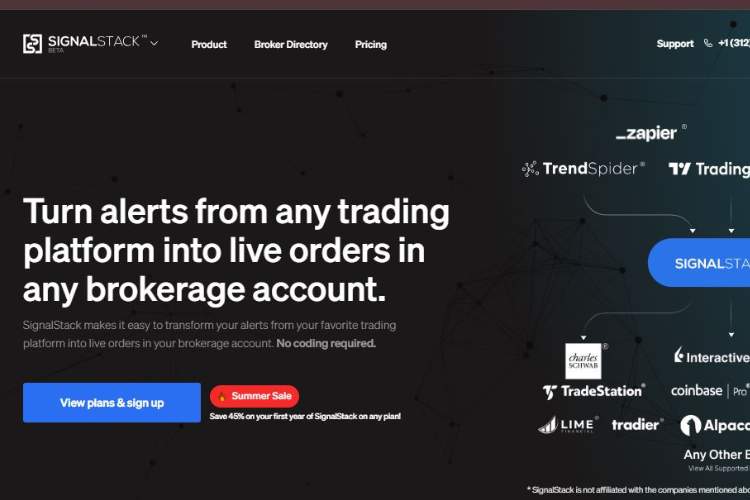

8. Signal Stack

Signal Stack connects alerts from TradingView or MetaTrader directly to automated execution. No clicking required—it just acts when your conditions are met.

Core Features & Use Cases

- Instant trade execution from chart alerts

- Multi-broker compatibility

- No coding required

Who is it for?

Alert-based traders who want zero lag between signal and trade.

Opinion

It made me feel fast—really fast. Perfect for catching sharp market moves.

9. TradingView

TradingView is the gold standard for charting, community sharing, and setting trade alerts. While it’s not an AI bot by itself, pairing it with Signal Stack or other automation tools turns it into a formidable Coinbase trading setup.

Core Features & Use Cases

- Advanced charting and indicators

- Pine Script for custom strategies

- Social sharing of trade ideas

Who is it for?

Any trader who wants a visual, community-driven platform for analysis and alerts.

Opinion

It’s where most of my trading ideas are born, even before AI touches them.

Conclusion & My Top 3 Picks

After months of juggling these tools, here are the three that earned a permanent place in my trading workflow:

- Bitsgap – Versatile, intuitive, and perfect for running multiple bots across exchanges.

- Coinrule – Gave me the control to create my own strategies without coding.

- Aterna AI – Reliable, low-stress, and ideal for steady portfolio growth.

If I had to sum it up, AI bots aren’t a magic bullet. But paired with a platform like Coinbase, they can turn good strategies into great executions—and free you from the grind of constant screen-watching.