There’s a lot of noise in the AI trading bot world. You’ve probably seen them—bold ads promising “guaranteed profits” or “set-and-forget millionaire systems.”

I’ve been trading long enough to know that’s marketing sugar. Still, I wanted to cut through the hype, test these bots myself, and see which ones actually deliver real, consistent value.

Over the past several months, I’ve been running multiple bots side-by-side, watching how they handle different market moods—bull runs, sudden dips, and those boring sideways drifts that test your patience.

Some impressed me with their discipline, others… well, they taught me how quickly a portfolio can look like a bad haircut.

This post isn’t about theory—it’s about hands-on experience. I’m walking you through the tools I’ve tested, what makes them tick, and whether they’re worth your time and trust.

Best AI Trading Bots That Actually Work

1. Coinrule

Coinrule is a no-code, rules-based automation platform for crypto traders. Imagine being able to program your trading strategy without touching a single line of code—just using “If This, Then That” style logic. That’s exactly what Coinrule offers. When I first tried it, I set up a rule that said, “If Bitcoin drops by 4% in a day, buy. If it climbs 6%, sell.” Within minutes, my strategy was live on my exchange, executing without me staring at the screen.

Coinrule integrates with major exchanges like Binance, Coinbase, Kraken, and others. It comes with dozens of pre-built strategy templates—ranging from simple stop-loss setups to more advanced momentum-based systems. The real win here is flexibility: you can start with a beginner template, then tweak it to match your style as you grow more confident.

Core Features & Use Cases

- No-code rule creation with real-time execution

- Pre-made strategy templates

- Works across multiple exchanges

- Backtesting tools to test strategies before risking real money

Who it’s for

DIY traders who want hands-on control over strategy design, but don’t want to mess with Python or APIs.

Opinion

Coinrule feels empowering—it’s like giving your trading brain an extra set of arms to execute your ideas instantly.

2. Intellectia

Intellectia is an AI-powered market insight platform that blends natural language understanding with predictive analytics. It’s like having a patient, data-driven friend who can explain market sentiment without talking down to you.

When I first tested it, I didn’t even start with crypto. I asked for a breakdown of the broader market mood, and Intellectia highlighted sectors, assets, and potential entry points. When I moved to crypto, it integrated cleanly with my workflow, giving me AI-curated watchlists and explaining why certain coins were worth monitoring.

Core Features & Use Cases

- Natural language market queries

- AI-curated watchlists and trend alerts

- Sentiment analysis drawn from multiple data sources

Who it’s for

Traders who like context before pulling the trigger—if you want to know why a trade might make sense, not just that it does.

Opinion

It made me feel less like I was gambling and more like I was making educated moves based on reasoning I could follow.

3. Bitsgap

Bitsgap is a multi-exchange trading platform with powerful automation features. It’s best known for its grid trading bots, which aim to profit from market volatility by buying low and selling high in small, repetitive moves.

I started with their demo mode, and within an hour, I was running live bots on Coinbase Pro and Binance.

What’s great is how Bitsgap doesn’t just automate—it also centralizes. You can track and trade across all your linked exchanges from one dashboard, which is a lifesaver when you’ve got positions scattered everywhere.

It also has futures trading, arbitrage tools, and DCA (dollar-cost averaging) bots for long-term strategies.

Core Features & Use Cases

- Grid, futures, and DCA bots

- Cross-exchange portfolio management

- Arbitrage detection and execution

- Backtesting before deployment

Who it’s for

Multi-exchange traders who want everything in one control center.

Opinion

Bitsgap became my “hub” for automated trading. When markets got choppy, its grid bots made me more in small bursts than my manual trades did.

4. Aterna AI

Aterna AI focuses on slow and steady growth through fully automated strategies. While many bots chase big moves, Aterna aims for around 4% monthly returns—a modest but realistic target. I initially brushed it off as “too safe” until I realized consistency is what keeps your account alive.

It’s hands-off: you set it up once, monitor occasionally, and let it run. The bot uses a policy-driven trading model that adapts to market conditions while minimizing risk.

Core Features & Use Cases

- Fully automated with minimal setup

- Stable, low-volatility strategies

- Built-in risk management

Who it’s for

Long-term investors who want to “set and forget” while avoiding emotional decision-making.

Opinion

It’s not flashy, but it’s reliable. I found myself checking it less, which was oddly liberating.

5. Signal Stack

Signal Stack is all about turning trading alerts into instant executions. You connect it to platforms like TradingView, set your alerts, and when the alert fires, the trade happens—no manual clicking, no hesitation.

Core Features & Use Cases

- Automates execution from TradingView alerts

- Supports multiple brokers and exchanges

- No coding required

Who it’s for

Alert-based traders who hate missing opportunities due to delays.

Opinion

It’s the middleman you didn’t know you needed—pure speed from idea to execution.

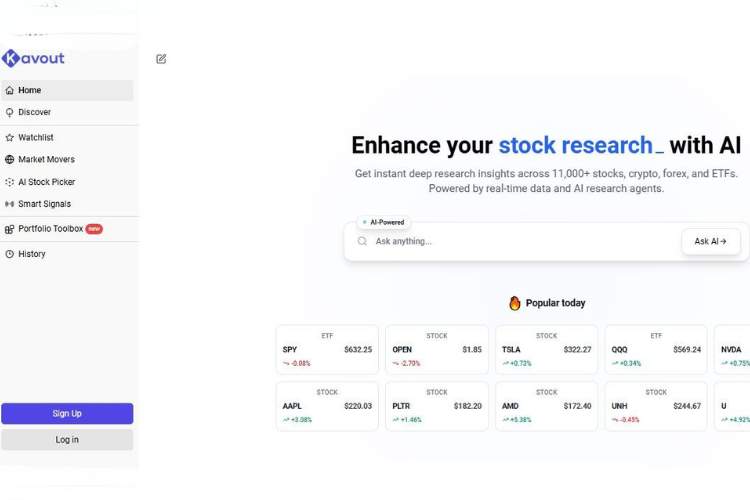

6. Kavout

Kavout is an AI-driven investment analytics platform that rates assets based on its “Kai Score.” Originally built for equities, it’s expanded into crypto. The AI sifts through technical, fundamental, and sentiment data to produce actionable rankings.

Core Features & Use Cases

- Kai Score asset rankings

- Machine learning-driven predictions

- Multi-asset coverage

Who it’s for

Data-driven traders who like quant-style decision-making.

Opinion

It gave me a new way to filter assets—especially useful when I wanted to narrow a long watchlist into a few high-probability plays.

7. TradingView

TradingView is the go-to charting platform for traders across all markets. It’s not a bot itself, but pair it with something like Signal Stack and you’ve got a powerful, automated setup.

Core Features & Use Cases

- Advanced charting and custom indicators

- Pine Script for custom strategies

- Community-driven trade ideas

Who it’s for

Any trader who relies on visual analysis and wants to integrate alerts into automation.

Opinion

It’s my trading “home base.” I rarely make a move without consulting it first.

Conclusion & Top 3 Picks

After months of testing, my top three are:

- Coinrule – For total strategy control without coding.

- Bitsgap – For multi-exchange efficiency and high-performing grid bots.

- Aterna AI – For stress-free, steady growth.

If you’re diving into AI trading, start with one of these, keep position sizes reasonable, and remember—bots can be smart, but markets are still wilder than any algorithm.