Diving into AI-powered trading is like getting a secret superpower—until, of course, you realize there’s a bit of setup and strategy involved. If you’ve been wondering whether AI tools can genuinely boost your Robinhood trades, you’ve hit the right page.

I’ve poked around, tested, and gathered 9 standout tools—from Tickeron to Bitsgap—that can fit various trading styles. Let’s cut through the noise and see which ones could actually move the needle for you.

Why AI Trading Matters More Than Ever

Markets today aren’t what they used to be even five years ago. With algorithmic trading dominating Wall Street, the average retail trader is effectively playing catch-up. Hedge funds employ massive teams of quants running AI-driven strategies that fire trades in milliseconds. You, on your laptop with Robinhood, can’t hope to compete at that speed. But what you can do is leverage AI tools designed for retail traders to help close that gap.

AI brings two big wins. First, it crunches data at scale. News headlines, technical indicators, historical performance—all processed in seconds. Second, it strips away some of the emotional mess that makes us sell too early or hold on for too long. If you’ve ever panic-sold only to watch the stock bounce back the next day, you know exactly what I mean.

For Robinhood users, this matters because the platform itself is stripped down. It’s sleek and beginner-friendly, sure, but lacks advanced analysis or strategy testing. That’s why pairing it with AI-based tools can give you a setup that’s lean, powerful, and tuned to modern markets.

The Emotional Side of Trading with AI

Let’s be real here—trading isn’t just numbers on a screen. It’s emotion, plain and simple. Fear, greed, excitement, and regret all fight for control of your next click. One of the most underrated benefits of AI trading bots is how they dampen that emotional noise.

I’ve spoken to countless traders who confessed they didn’t necessarily lose because their strategy was bad. They lost because they didn’t stick to it. AI bots don’t care if the market feels scary. They don’t care if you just had a rough day at work and want to “win one back.” They execute based on logic, not your mood swings.

That said, using AI doesn’t mean you’re suddenly stress-free. There’s still that twitchy feeling when you watch a bot execute trades you might not have made yourself. Trusting the process is its own skill. But once you get there, the emotional relief is undeniable. Instead of babysitting charts at 2 a.m., you let the bot grind it out while you get some sleep.

Risks and Realities You Shouldn’t Ignore

It’d be misleading to act like AI is a magic ticket. Bots aren’t crystal balls—they’re tools. They can help you read patterns, test strategies, or automate execution, but they’re not immune to market chaos. Unexpected news events, regulatory shifts, or even simple volatility can throw predictions out the window.

Also, not all bots integrate smoothly with Robinhood. Some require API connections or middle-layer platforms, and depending on your comfort level with tech, that can be a hurdle. You also need to think about costs. Subscriptions, fees, or percentage cuts can eat into profits if you’re not careful.

And here’s the kicker: sometimes the hardest part isn’t choosing the tool, it’s choosing when to stop tinkering with it. Many traders end up over-optimizing their strategies, constantly adjusting settings, and ironically losing the edge the AI was meant to give them. Balance is the key here. Let the AI do its thing, but keep your hands on the wheel.

Best AI Stock Trading on Robinhood

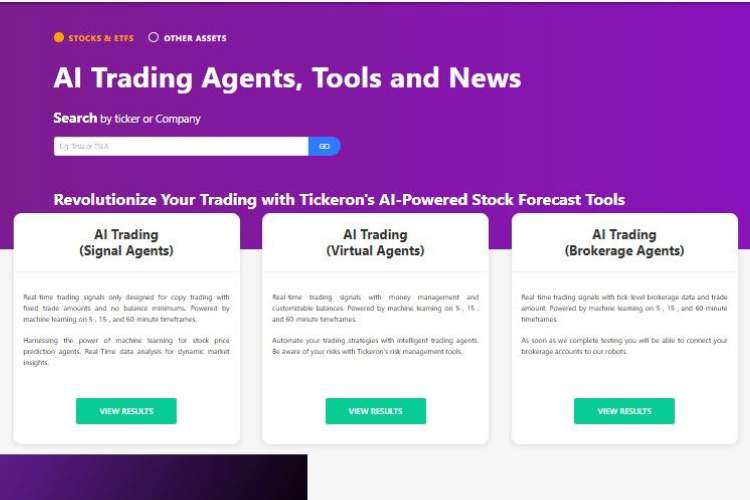

1. Tickeron

What is it?

Tickeron is more than just a flashy name. It’s a full-blown AI trading platform that works equally well for click-happy day traders or buy-and-hold investors. What grabbed my attention: those AI trading robots that deliver up to 86.6% win rates on ETFs. Stats like that don’t land in your lap every day.

The platform includes signal agents, virtual agents, and a community marketplace where you can mirror other users’ strategies. It also offers pattern recognition—a godsend when you’re trying to make sense of crowded charts in real-time.

Core Features & Use Cases

- AI-powered signal generators and pattern scanners

- Brokerage agent integration for automated or manual trading

- Copy trading from community-shared bots and models

People who need real-time hot takes paired with a safety net—like orchestral traders—will appreciate Tickeron.

Who’s it for?

Active traders, swing players, and anyone who wants a system that’s both brainy and manageable.

Reference: detailed agent features can be found on their AI trading page.

2. Intellectia AI

What is it?

Think of Intellectia as your AI-backed financial ally—voice it your daily investing GPT. With handy features like AI Stock Picker, Swing Trading signals, and a financial agent that adapts based on your market mood, this platform feels both ambitious and approachable.

For day traders it even offers a pre-market movers list—that simple get-ahead snapshot before the markets pop open.

Core Features & Use Cases

- AI-driven stock screening, signal generation, and recommendations

- Real-time alerts via Stock Monitor, access to analyst-like insights

- Beginner-friendly pricing tiers plus a “dip your toes” trial offer

Ideal for traders who want smarts without the jargon-heavy dashboards.

Who’s it for?

Novices dumped into markets, casual traders, and the snap-decision crowd.

Source info from feature breakdown and real-user guide.

3. Aterna AI

What is it?

Aterna throws modest flair at algo trading. The core: Trad3r V1, an AI trading engine promising a steady 4% per month. That’s not moonshot returns, but steady, measured gains that could actually feel attainable. Sounds almost suspiciously calm for this wild market—so it caught my interest.

Core Features & Use Cases

- Hands-off AI trading engine making calculated moves based on data

- Built more for automation than show, targeting long-term growth

Who’s it for?

Investors who want “set and forget” simplicity—especially those juggling full schedules or not wanting to babysit trades.

Cited from Aterna’s site and investor overview.

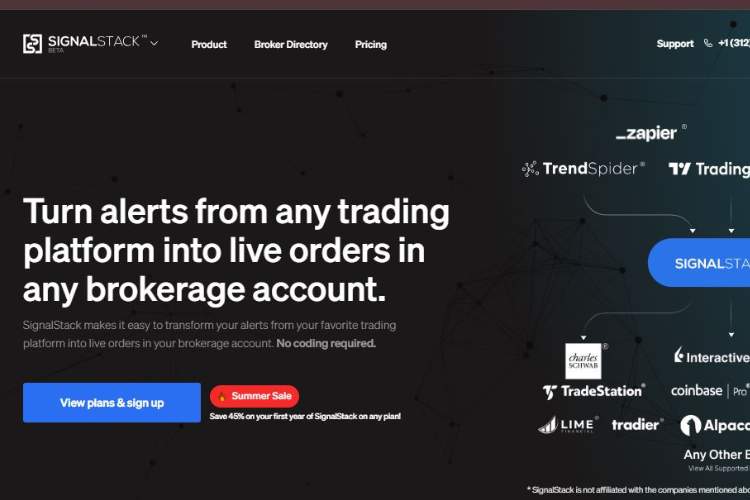

4. Signal Stack

What is it?

No-code trading alert lifeline: Signal Stack doesn’t guess your strategy; it automates it. If you’ve got alerts firing off from TradingView or MetaTrader, Signal Stack routes them into real-time trades with no manual entry.

Core Features & Use Cases

- Converts chart signals into trades across 33+ brokerages

- Lightning-fast execution and near-perfect uptime

Who’s it for?

Traders who already rely on chart tools and want to dodge order delays or emotional slip-ups—especially those on Robinhood-style platforms.

Expanded from authoritative signal platform breakdown.

5. TradeIdeas

What is it?

This one’s a data junkie’s dream. TradeIdeas is full-tilt with real-time stock scanning, alerts, strategy backtesting, and a chat-based virtual assistant (Holly AI). It’s like a research desk that never sleeps.

Core Features & Use Cases

- Live scanning, customizable alerts, virtual assistant help

- Backtesting with OddsMaker, simulated trading via Brokerage+

Who’s it for?

Day traders or power users who want the full suite—chasing every moment, every alert, every edge.

Built from official feature listings and review.

6. TradeSanta

What is it?

TradeSanta sits firmly in the crypto world. Bots run 24/7, trading spot or futures, with risk tools like stop-loss and take-profit baked in. Grid bots, DCA strategies, and Telegram alerts keep it ticking quietly but firmly.

Core Features & Use Cases

- Custom bots, compatible with major exchanges

- Strategy templates, real-time notifications, mobile access

Who’s it for?

Crypto traders who are active, but not glued to screens. Let automation do the work while you live life.

Sources include official platform summary and risk tool coverage.

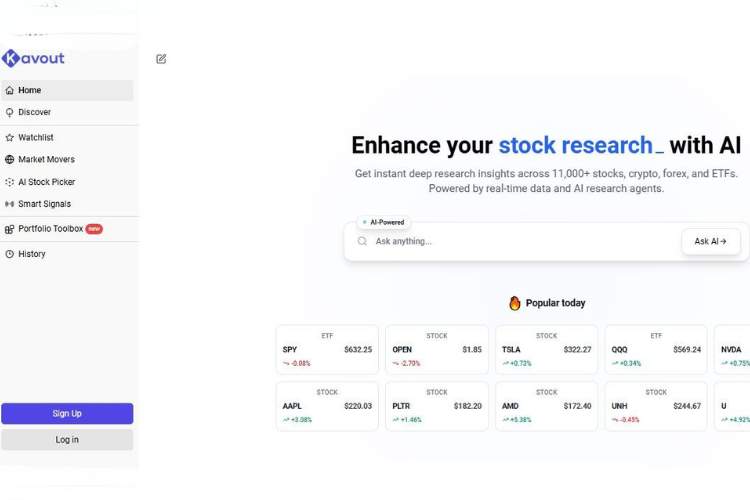

7. Kavout

What is it?

Kavout feels like institutional-grade AI for retail users. With features like InvestGPT, AI Stock Picker, Technical Analyst, and portfolio builders, it tells you not just what to trade but why.

Core Features & Use Cases

- Cross-asset analysis: stocks, ETFs, crypto, forex

- Portfolio optimization, factor investing, AI signals

Who’s it for?

People who want smart ideas with rationale. Ideal for thoughtful investors seeking structure with AI support.

Refined from Kavout product breakdowns and insights.

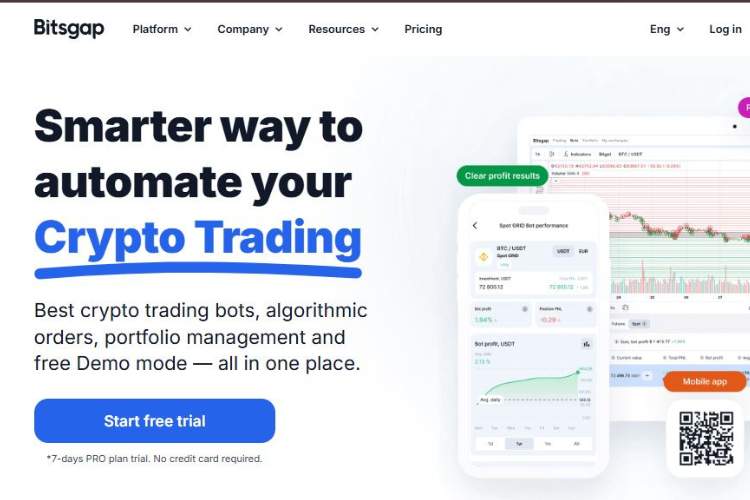

8. Bitsgap

What is it?

Here’s your multi-exchange crypto command center. Bitsgap’s AI Assistant helps configure bots, while its terminal covers trades, charts, and automation across platforms like Binance or OKX.

Core Features & Use Cases

- Multiple bot types (DCA, GRID, BTD, combo), backtesting, bot rankings

- Centralized terminal, portfolio management, AI strategy suggestions

Who’s it for?

Crypto pros who hate window-hopping and want consolidated control, with AI recommendations in tow.

Info from comprehensive platform reviews and listings.

Conclusion & Picks

Man, that was a ride. Each tool serves a different trader vibe—from students doing finals week who want TradeSanta’s automation, to chart junkies who need TradeIdeas or Tickeron for signal overload. If I had to pick the top 3, here’s where I’d put my money:

- TradeIdeas – Because if you want data and depth and automation, it’s hard to beat.

- Intellectia AI – Accessible, versatile, and friendly for beginners or part-timers.

- Tickeron – Serious AI power, signal variety, and copy-trading community.

Of course, pick what fits your hustle: automated bots for sleep trading, hybrid tools for deeper insights, or just signals you run yourself. Just remember: AI is a tool, not a guru. Keep your mind in gear too.

Let me know if you want a deeper dive into one of these, or how they pair specifically with Robinhood’s interface.