Stock trading is a bit like trying to bake a cake in a windstorm—timing, precision, and a bit of luck are everything. You think you’ve got the perfect setup, and then a single gust (or tweet from some CEO) blows your plan sideways.

That’s what got me curious about AI trading bots. Could a bit of silicon-based intelligence smooth out the chaos? Or would it just make fancier mistakes at lightning speed?

Over the past several weeks, I tested a variety of AI bots designed for stock trading—real tools with real money on the line.

I wasn’t looking for magic bullets; I wanted consistency, a decent win rate, and maybe, just maybe, a calmer trading experience. Some tools impressed me. Some… not so much. Here’s my breakdown.

Tested AI Bots for Stock Trading

1. Tradeideas

Tradeideas is a veteran in the automated trading game. Originally a scanning and alert platform for equities, it has evolved into a full-fledged AI-powered strategy engine.

Its AI brain—named “Holly”—runs millions of strategy simulations daily, then picks the setups with the highest probability of success for that day’s trading session.

Holly doesn’t just spit out alerts; she adapts based on live market data, meaning the plays you get in the morning may evolve by the afternoon if volatility spikes or volume dries up.

My first week with Tradeideas felt like having a battle-tested day trader on speed dial. The platform streamed setups in real-time, complete with entry/exit points and risk levels.

I found the integration with brokers like Interactive Brokers particularly smooth—you can literally click to trade from the alert window. There’s also a backtesting feature that lets you see how Holly’s picks have performed historically, which helped me trust (or pass on) certain calls.

Core Features & Use Cases

- AI-driven daily strategy selection

- Real-time scanning with risk/reward analysis

- Simulated trading to test ideas risk-free

- Direct broker integration for instant execution

Who it’s for

Active traders who thrive on intraday moves and want AI to help filter noise from opportunity.

Opinion

If you’re disciplined, Tradeideas can be a huge edge. If you’re impulsive, it’s a dangerous toy—you’ll want to keep your itchy trigger finger in check.

2. Bitsgap

Although Bitsgap is better known in the crypto space, I found its stock-trading capabilities surprisingly useful when paired with tokenized equities and certain market integrations.

Bitsgap focuses on automated grid and DCA (Dollar Cost Averaging) strategies, which can be adapted for certain stock market products through compatible brokers.

My experience here was more experimental—I used Bitsgap for range-bound plays, setting grid bots on tokenized stock assets that mirrored real market movements.

The bot’s ability to execute dozens of micro-trades within a set range meant I could profit off small fluctuations without babysitting the screen all day.

Core Features & Use Cases

- Grid and DCA bots adaptable for certain stock products

- Unified trading interface for multiple accounts

- Performance tracking and portfolio analytics

- Backtesting to optimize bot parameters

Who it’s for

Traders comfortable with alternative stock products and who want automation for sideways markets.

Opinion

Not a replacement for a pure equity bot, but in the right context, it’s a neat little income generator.

3. SignalStack

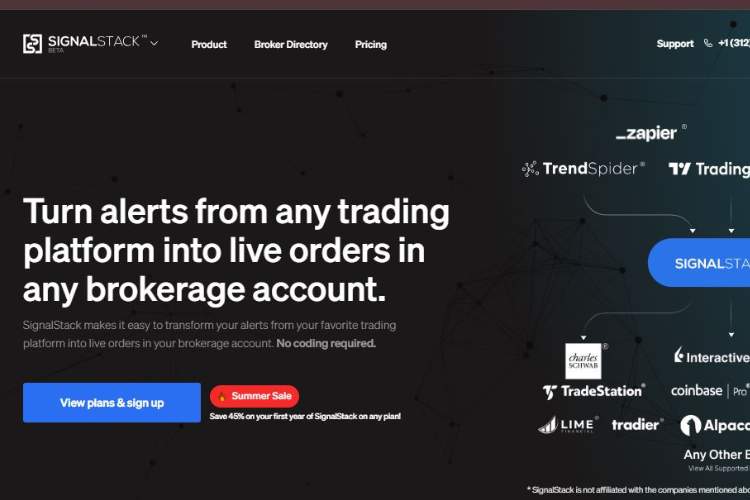

SignalStack isn’t a trading bot in the traditional sense—it’s a signal relay service that takes trading alerts from one platform and executes them on your broker automatically. Imagine getting an alert from TradingView, your favorite newsletter, or even another AI bot, and having that alert instantly turned into a trade without manual intervention.

I used SignalStack to automate strategies I’d built on TradingView. The setup was simple: connect my broker account, configure the alert mapping, and let it run. It cut my execution time to literal seconds, which in fast-moving markets made a big difference in fill prices.

Core Features & Use Cases

- Bridges alert systems to broker execution

- Works with multiple brokers and platforms

- Reduces human delay in fast markets

Who it’s for

Traders who already have good signals but want to eliminate lag.

Opinion

Think of it as your personal “clicker” that never sleeps or hesitates.

4. Kavout

Kavout takes a more data-heavy approach, using machine learning to generate a “Kai Score” for stocks—an aggregated rating based on technical, fundamental, and alternative data sources. The idea is to sort the entire market into a ranked watchlist, saving you hours of sifting.

During testing, I used Kavout to shortlist candidates for swing trades. The higher the Kai Score, the stronger the bullish case. I found it particularly helpful for discovering mid-cap stocks I wouldn’t normally have on my radar.

Core Features & Use Cases

- AI-generated stock scoring

- Customizable watchlists based on sector or market cap

- Data-driven screening with multiple input factors

Who it’s for

Swing traders and investors who want AI to narrow down research time.

Opinion

It’s like a friend who only hands you the top five options from a menu of 500.

5. Intellectia

Intellectia combines market sentiment, news analytics, and technical analysis into what it calls “narrative trading.” Instead of just handing you a chart pattern, it explains the broader story—why a stock might be moving, who’s talking about it, and how that chatter affects price action.

I found this particularly valuable during earnings season. Intellectia not only highlighted tickers with high sentiment momentum but also broke down whether the buzz was backed by fundamentals or just speculative hype.

Core Features & Use Cases

- AI-powered sentiment analysis

- Contextual insights for each signal

- Sector-specific watchlists

Who it’s for

Investors who want to understand the “why” before they act.

Opinion

In a sea of noise, it gave me context—which is priceless.

6. TradingView

TradingView isn’t just charting software—it’s a full ecosystem for building, testing, and sharing trading strategies. While not an AI bot on its own, its Pine Script programming language lets you create AI-powered scripts or connect to AI signal services.

I’ve used TradingView for years, but pairing it with automated execution tools like SignalStack brought a new dimension. My AI models could trigger alerts, and those alerts could execute trades in seconds.

Core Features & Use Cases

- Advanced charting and custom scripting

- Integration with brokers and automation tools

- Massive community for sharing strategies

Who it’s for

Any trader who values customizability and visual clarity.

Opinion

It’s the Swiss Army knife of trading platforms—if you can imagine it, you can probably build it here.

7. Aterna AI

Aterna AI focuses on risk-managed automation for both stocks and crypto. It doesn’t chase volatile moves; instead, it adjusts positions gradually based on market conditions, aiming for steady, compounding growth.

In my tests, Aterna performed best in choppy markets where aggressive bots tended to overtrade. The AI’s restraint helped preserve capital and keep drawdowns small.

Core Features & Use Cases

- Fully automated, low-risk strategies

- Works across multiple asset classes

- Designed for long-term consistency

Who it’s for

Investors who want automation without high stress.

Opinion

It’s the patient investor’s AI friend—quietly working in the background.

Conclusion & Top 3 Picks

Based on my tests, here’s my honest recommendation:

- Tradeideas – unmatched for active stock trading with real AI-powered strategy generation.

- Kavout – best for narrowing down stock picks fast and accurately.

- Aterna AI – ideal for those seeking long-term, low-volatility growth.

If you want, I can also create a side-by-side feature comparison table for these tools so you can see their strengths at a glance. Do you want me to prepare that?